RECEIVE QUALITY TAX TRAINING IN ENGLISH & SPANISH

CHOOSE YOUR COURSE BELOW

TaxSlayer Pro has partnered with Latino Tax Pro to provide our preparers with bilingual tax education.

Use code: Taxslayerpro20

ANNUAL FILING SEASON PROGRAM

(AFSP)

CONTINUING EDUCATION BUNDLE

(CE)

HOW WOULD YOU LIKE TO PREPARE AN EXTRA 700+ TAX RETURNS DURING TAX SEASON?

Starting YOUR tax school is simple! Latino Tax Pro (LTP) creates everything for you!

LTP’s Instructor Program is part of a complete Professional Training System that turns your office into a Virtual Training Center where you can train your way, recruit high-quality employees to grow your business, and reduce your stress!

ABOUT THE ANNUAL FILING SEASON PROGRAM

Deadline to Complete Course is 31 by Midnight your time zone.

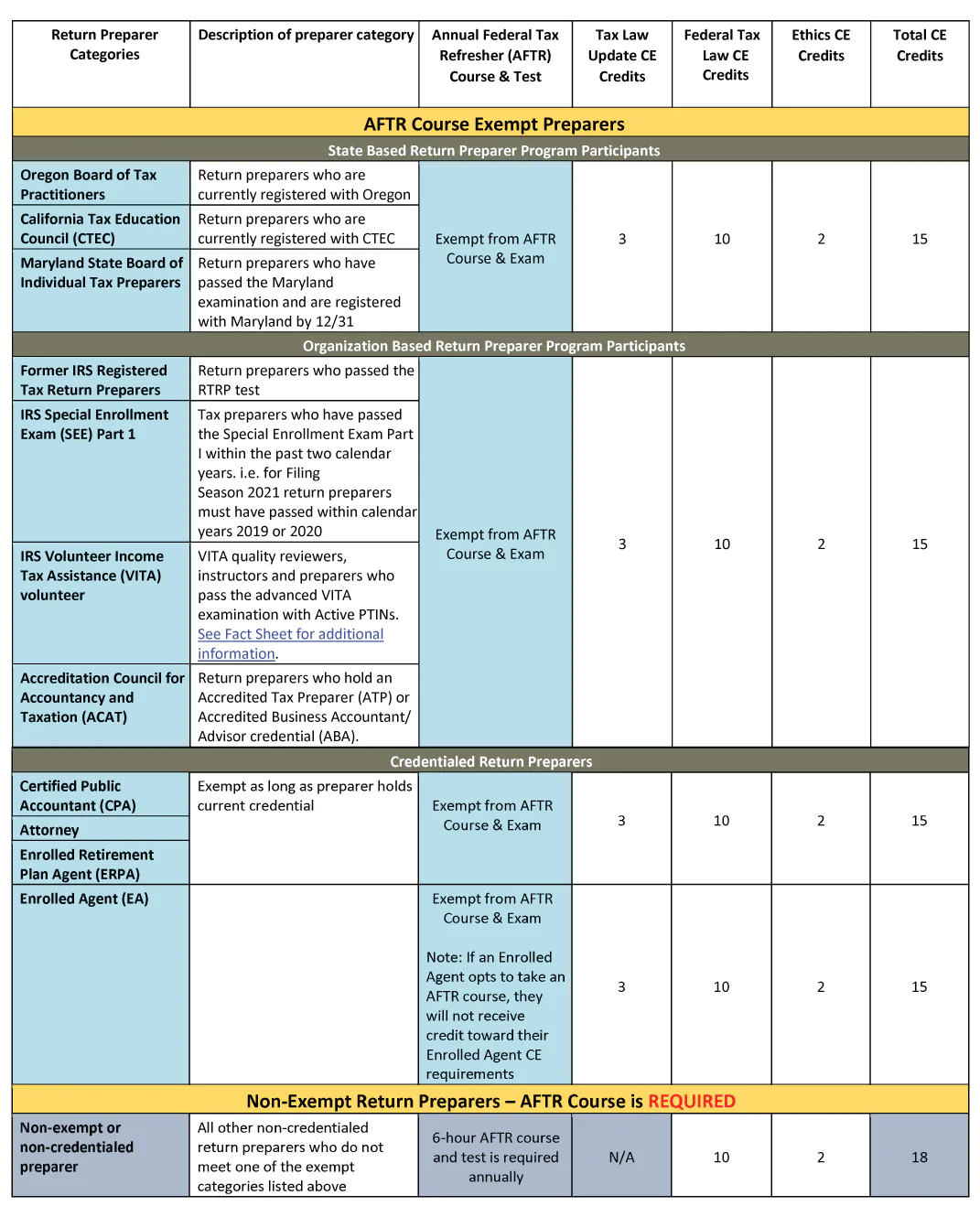

The AFSP is an annual voluntary program for tax return preparers. It aims to recognize the efforts of non-credentialed tax return preparers who aspire to a higher level of professionalism.

• Take a six (6) hour Annual Federal Tax Refresher (AFTR) course that covers filing season issues and tax law updates, as well as a knowledge-based comprehension test administered at the end of the course by the CE Provider.

• Take ten (10) hours of other federal tax law topics; and

• Take two (2) hours of ethics.

• Have an active preparer tax identification number (PTIN).

• Consent to adhere to Circular No. 230.

• Anyone who passed the Registered Tax Return Preparer test administered by the IRS between November 2011 and January 2013.

• Established state-based return preparer program participants currently with testing requirements: Return preparers who are active registrants of the Oregon Board of Tax Practitioners, California Tax Education Council, and/or Maryland State Board of Individual Tax Preparers.

• SEE Part I Test-Passers: Tax practitioners who have passed the Special Enrollment Exam Part I within the past two years.

• VITA/TCE volunteers: Quality reviewers, instructors, and return preparers with active PTINs.

• Other accredited tax-focused credential-holders: The Accreditation Council for Accountancy and Taxation’s Accredited Business Accountant/Advisor (ABA) and Accredited Tax Preparer (ATP) programs.

Enrolled agents (EA) are exempt from the AFTR course & exam. If the Annual Filing Season Program is completed, EA’s will only earn the 10 hours of tax federal tax law and 2 hours of ethics.If an EA opts to take an AFTR course, they will not receive credits toward their CE requirements.